What the VN-Index Tells Us About Vietnam’s Investment Climate in 2025

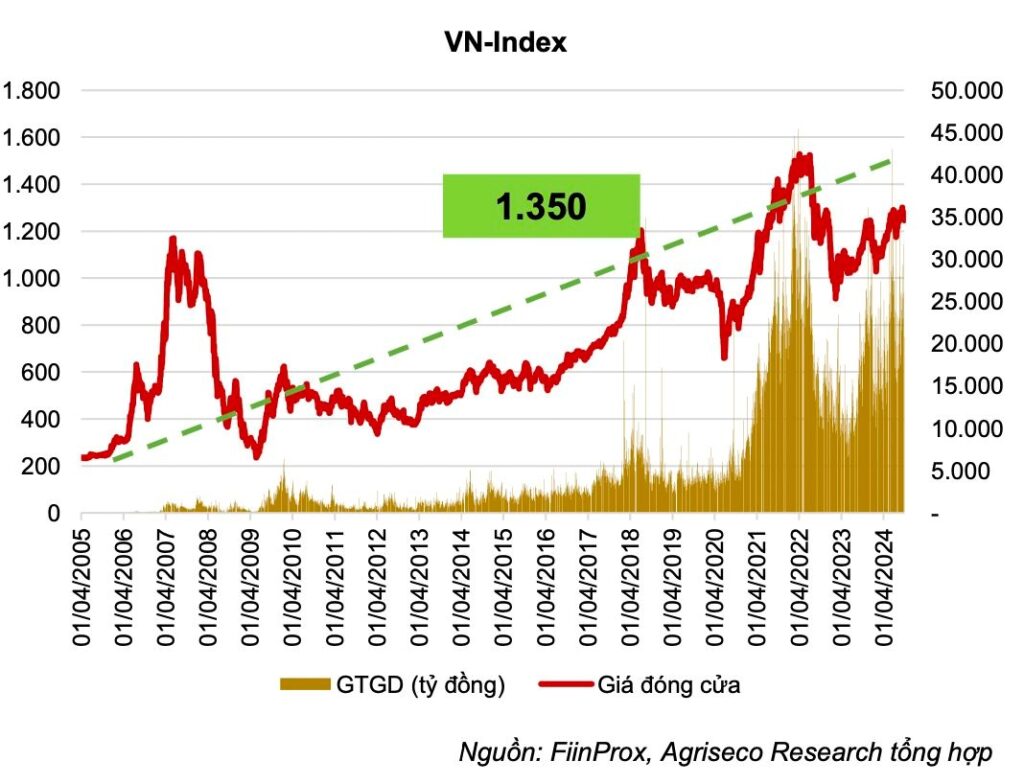

Vietnam’s VN-Index, the benchmark of the Ho Chi Minh Stock Exchange (HoSE), serves as a vital indicator of the country’s economic health and investment appeal. As of May 2025, the VN-Index reflects a dynamic interplay of domestic growth, global economic shifts, and investor sentiment. This article delves into the VN-Index’s performance and its implications for Vietnam’s investment climate in 2025.The Investor+1The Investor+1

VN-Index Performance: A Mirror to Economic Resilience

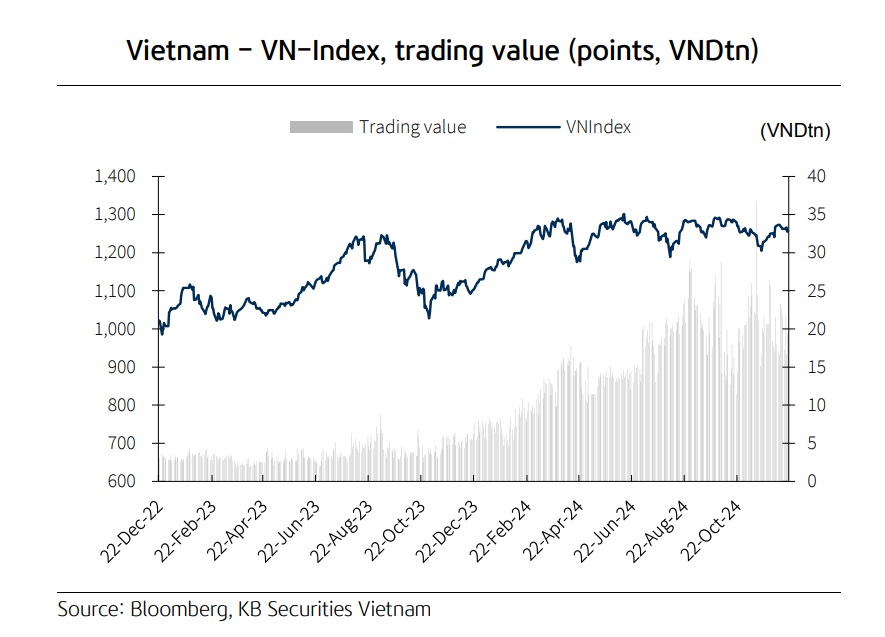

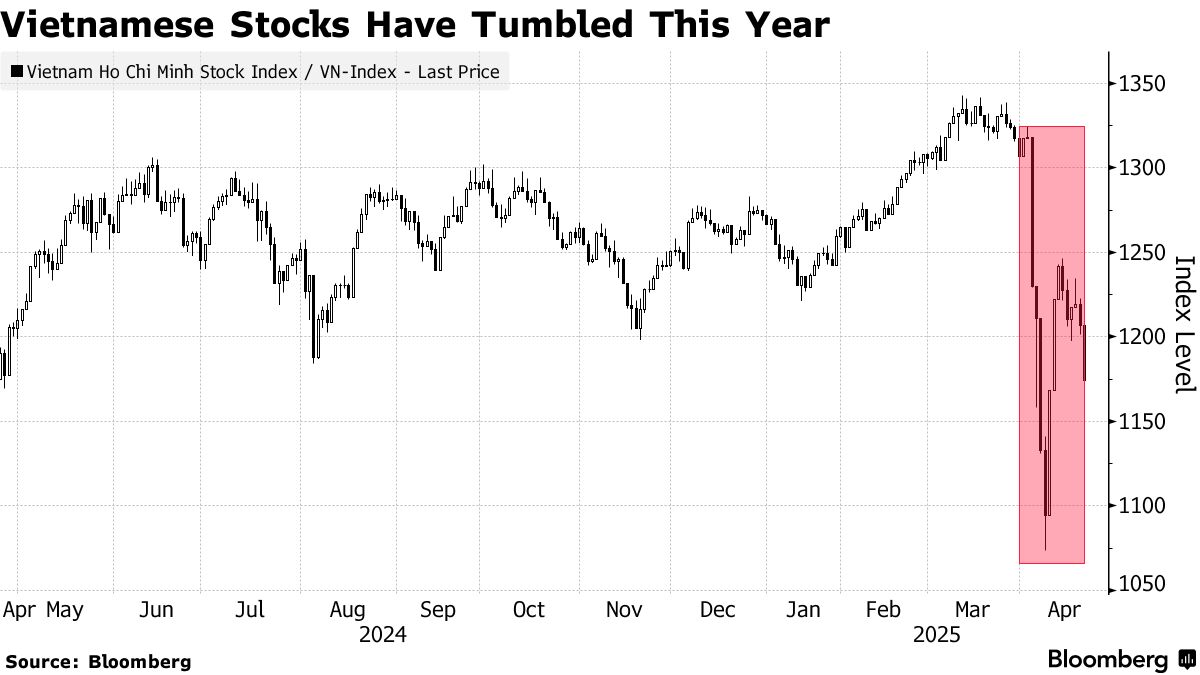

In early 2025, the VN-Index experienced significant volatility. Notably, on April 3, it suffered its steepest decline, dropping nearly 88 points (6.68%) to 1,229.84, erasing gains accumulated since the year’s start. This downturn was largely attributed to external shocks, including unexpected U.S. tariff announcements. The Investor+1The Investor+1The Investor

However, the index demonstrated resilience. By mid-May, it rebounded to 1,293.43 points, buoyed by positive global market trends and easing trade tensions. This recovery underscores Vietnam’s robust economic fundamentals and the market’s adaptability to external pressures.The Investor

Macroeconomic Indicators: Underpinning Market Confidence

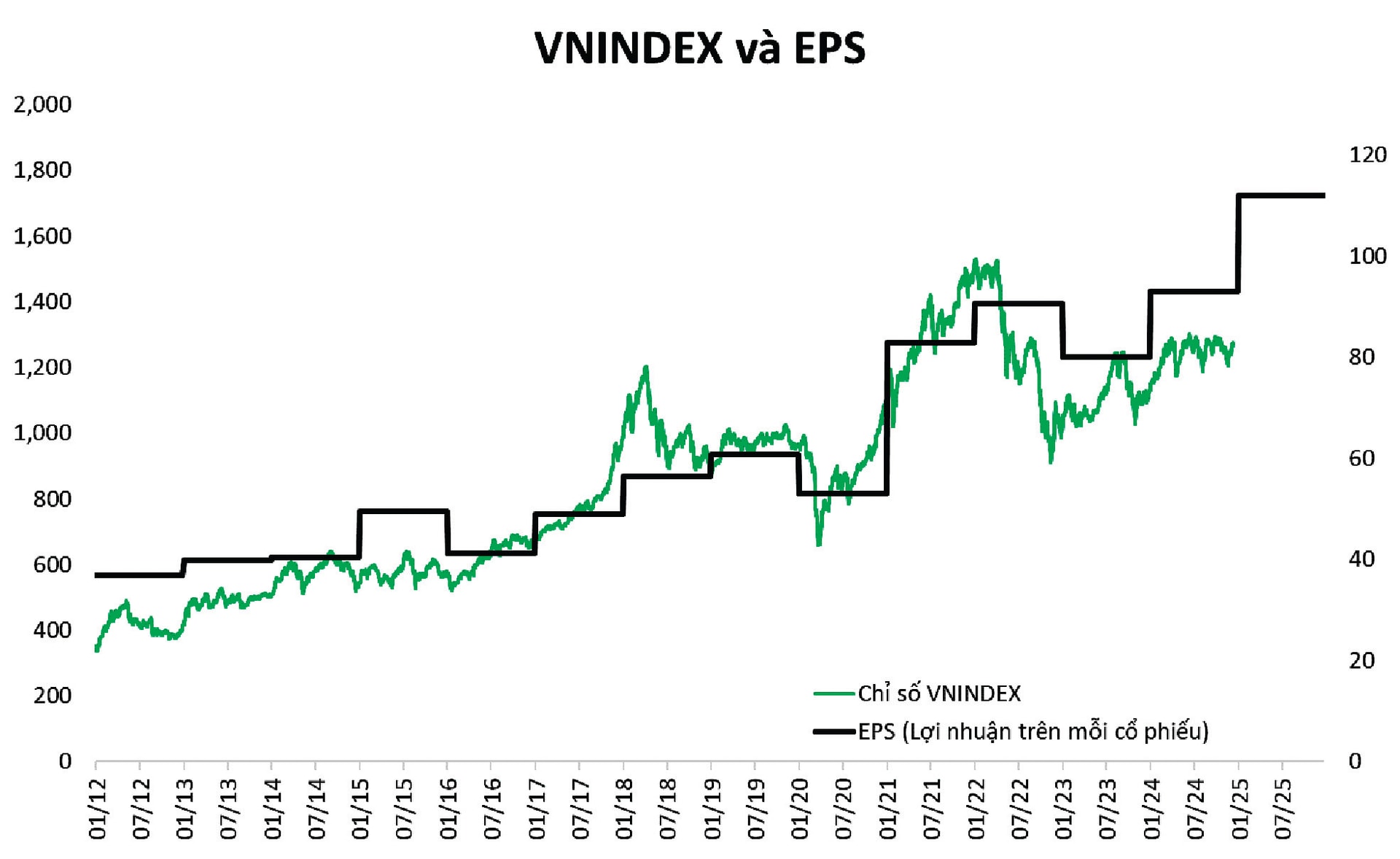

Vietnam’s economic outlook in 2025 remains optimistic. The World Bank projects a GDP growth rate of 6.8%, driven by strong domestic consumption, export expansion, and public investment. Inflation is expected to be contained within 4-4.5%, maintaining macroeconomic stability. ASEAN Exchanges+1Vietnam Briefing+1World BankThe Investor

These favorable conditions have attracted substantial foreign direct investment (FDI), with registered capital reaching $10.98 billion by March 31, marking a 34.7% year-on-year increase. The influx of FDI, particularly in high-tech and manufacturing sectors, reflects investor confidence in Vietnam’s growth trajectory.GSO+1Vietnam+ (VietnamPlus)+1

Sectoral Insights: Identifying Growth Engines

Banking and Finance: The banking sector has posted impressive earnings in Q1 2025, reinforcing its role as a market driver. Vietnam+ (VietnamPlus)

Technology and Manufacturing: Vietnam’s push towards digitalization and its strategic position in global supply chains have made technology and manufacturing sectors attractive to investors. Vietnam Briefing

Renewable Energy: The government’s commitment to sustainable development has spurred investments in renewable energy, aligning with global ESG trends.

Market Dynamics: Balancing Opportunities and Risks

While the VN-Index’s recovery signals positive momentum, investors should remain cognizant of potential risks:Vietnam+ (VietnamPlus)

-

Global Economic Uncertainties: Geopolitical tensions and shifts in global trade policies can impact market stability.

-

Domestic Challenges: Structural reforms and regulatory changes may introduce short-term uncertainties.

-

Investor Behavior: Continued net selling by foreign investors, as observed in early 2025, could influence market liquidity and sentiment. Eastspring Investments

Despite these challenges, the VN-Index’s performance indicates a market that is responsive and resilient, offering opportunities for informed investors.

Conclusion: VN-Index as a Barometer for Investment Climate

The VN-Index in 2025 encapsulates Vietnam’s economic vigor and the evolving investment landscape. Its performance reflects the country’s ability to navigate external shocks and maintain growth momentum. For investors, the VN-Index serves as a valuable tool to gauge market sentiment and identify emerging opportunities within Vietnam’s dynamic economy Vietnam-Agent.com .

Further Reading: